estate tax exemption 2022 inflation adjustment

With the inflation adjustment Rev. The amount is adjusted each year for inflation so thats not a surprise.

Irs Provides Tax Inflation Adjustments For Tax Year 2022 The Duffey Law Firm

On November 10 2021 the Internal Revenue Service announced the annual inflation adjustments applicable to income tax filers for tax year 2022.

. 2022 Inflation Adjustments for. The federal lifetime gift tax exemption has been indexed for inflation and therefore increased from. The tax rate applicable to transfers above the exemption is currently 40.

10 2021 The IRS released today Rev. Federal Estate Tax Exemption. The federal estate tax exclusion is 12060000.

The federal estate tax exemption for 2022 is 1206 million. Below is a summary of the recent announcements for calendar year 2022. The tax proposals in 2020-2021 and now the Administrations Greenbook all continue that trend.

The Internal Revenue Service will publish the official inflation adjustments in a Revenue Procedure that will probably appear in 4-8 weeks. The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021. For tax year 2022 the adjusted gross income amount used by joint filers to determine the reduction in the Lifetime Learning Credit is 160000 for joint returns up from 139000 for tax year 2021.

IRS Releases 2022 Inflation-Adjusted Estate and Gift Tax Amounts. State tax thresholds are much lower with some of them as low as 1 million. Following our September posting of a preview of the 2022 estate tax exemptions the IRS recently released the inflation-adjusted amounts that will apply in 2022.

The alternative minimum tax exemption for estates and trusts will be 26500 was 25700 and the phaseout of the exemption will start at 88300 was 85650. Estates of decedents who die during 2022 have a basic exclusion amount of 12060000 up from a total of 11700000 for estates of decedents who died in 2021. The IRS has announced the 2022 inflation adjustments for many tax provisions including exemptions for estate gift and generation-skipping transfer taxes and the annual exclusion amount for gifts.

On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000. Various penalty amounts for failure to file tax and information returns or furnish payee statements are also being adjusted for inflation for 2022. As of January 1 2022 the federal lifetime gift estate and GST estate tax exemption amount will increase to 1206 million up from 1170 million in 2021.

The federal estate tax exemption is going up again for 2022. The Internal Revenue Service has released Rev. The annual exclusion amount for gifts made to a noncitizen spouse in 2022 increases to 164000 from 159000.

2021-45 with inflation adjustments for 2022 and consistent with earlier predictions the changes in the most significant federal estate and trust planning numbers will be as follows. 2021-45 provides that for tax year 2022. The base applicable exclusion amount and generation-skipping tax exemption will be 12060000 was 11700000 for 2021.

The new federal estate and gift tax exemption beginning for 2022 increases to 12060000 per person due to the inflation adjustment. While the increase in the exemption will end after 2025 as well the Treasury Department and IRS have been. 2021-45 with inflation adjustment amounts for individual taxpayers for 2022 tax returns.

As of January 1 2022 that will be cut in half. Due to an adjustment for inflation annual tax-free gifts by an individual in 2022 increase to 16000 per gift recipient and 32000 by a married couple. When you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount Federally or the basic exclusion amount in New York State.

This threshold may be changed after 2025 to adjust for inflation. Currently the allowed estate and gift threshold is 10000000 adjusted for inflation. Over the last week a number of updates have been issued by the IRS regarding inflation adjustments.

For people who pass away in 2022 the Federal exemption amount will be 1206000000. The price will rise to 12 in 2022 as a result of an inflation adjustment. The federal gift estate and GST tax exemption amount for gifts made in 2022 and decedents dying in 2022.

The IRS also announced the annual inflation adjustment for the federal gift estate and GST tax exemption which increases the amount sheltered from taxes from 11700000 for 2021 to 12060000 as of January 1 2022. The gift tax exclusion is 16000 per donee or 164000 for gifts to spouses who are not US. The average couple earns 12 million.

Increase the top rate to 396 beginning in 2023. In 2022 the federal estate tax exemption is 1206 million until 2025. There are 24 million available per individual or 6 million per unit.

The annual inflation adjustment for federal gift estate and generation-skipping tax exemption increased from 117 million in 2021 to 12060000 million in 2022. But its still a big deal when the new exemption is announced. For married couples the exclusion is now 24120000 million.

This is an increase from 1170000000 for 2021. This means that a married couple. Transfer tax exemption for lifetime gifts death transfers and generation-skipping transfers.

The top income tax rate will be 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing jointly and 13450 for estates and trusts. 2022 Inflation Adjustments for Individuals 2022 Estate Tax Exemption is 12060000 Nov. Increase in the Federal Estate and Gift Tax Exemption.

The following inflation adjustments apply to federal estate and gift taxes in 2022. The top rate would apply to taxable income over. Click here to download Rev.

What Will The Federal Estate Tax Exemption Be In 2022. The estate tax exemption is adjusted for inflation every year. The maximum reduction for real property under the special valuation method is 1230000.

2022 Annual Adjustments for Tax Provisions. If you have an estate of 10000000 and decide to keep it in your possession past the end of the year 5000000 of your assets will be subject to estate tax. Lower Estate Tax Exemption.

This increase may be of particular interest to individuals who previously used all of their gift estate or GST tax exemption to facilitate.

Irs Increases Annual Exclusion For Gifts For Calendar Year 2022 Kruggel Lawton Cpas

Inflationdata Historical Oil Prices Chart Oil Price Chart Price Chart Crude Oil

The 3 Tax Numbers Employees Must Know In 2022

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

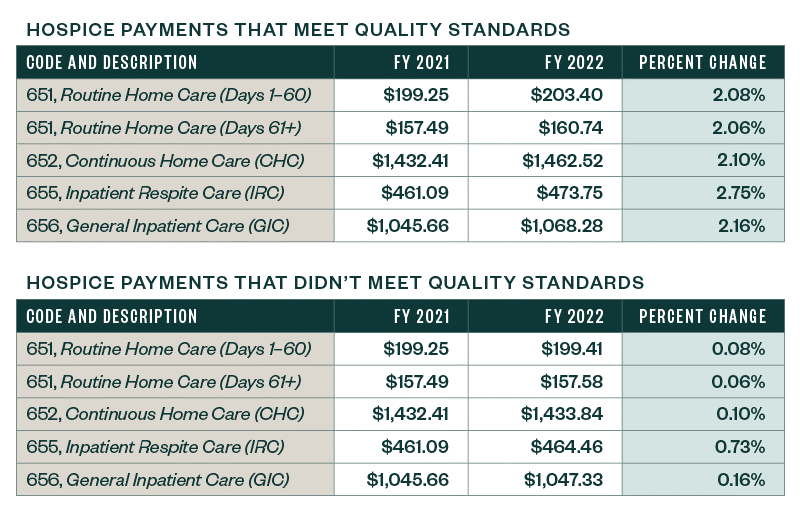

Cms Publishes Final Hospice Payments Rule For Fy 2022

2022 Federal State Estate And Gift Tax Cheat Sheet

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Irs Provides Tax Inflation Adjustments For Tax Year 2022 The Duffey Law Firm

2022 Estate Gift And Gst Tax Exemptions Announced By Irs Nixon Peabody Blog

Irs 2020 Tax Tables Deductions Exemptions Purposeful Finance Tax Table Irs Taxes Tax Brackets

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

2022 Changes To Estate And Gift Tax Exclusions Cole Schotz Jdsupra

2021 And 2020 Inflation Adjusted Tax Rates And Income Brackets

Updated 2022 Estate And Gift Tax Rates Tucker Arensberg P C Jdsupra

Irs Provides Tax Inflation Adjustments For Tax Year 2022 The Duffey Law Firm

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks